The new 13.5% VAT rate will enter into force in Finland as of 1 January 2026.

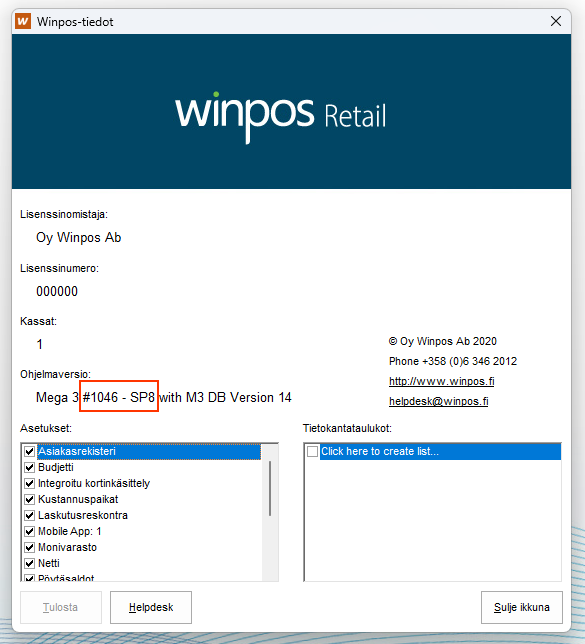

Before making any changes, first check in the Backoffice program, which program version you have.

You can find the software version information in the “About Winpos” window of Winpos Backoffice. Open Backoffice -> About Winpos

Note!

If you use Finvoice or Procountor, notify this to alv.info@winpos.fi no later than 19.12.2025. Your program version requires a separate update before you can make the VAT changes according to the instructions below. If you have already made the update in connection with the previous VAT change, no further update is required.

Instructions for making VAT changes in your Winpos POS system:

Winpos Mega Store version instructions

- If your program version is 1046-SP8 (or later):

See instructions here (PDF) - If your program version is any other than 1046-SP8, and you have a small number of products affected by the VAT change:

See instructions here (PDF) - If your program version is any other than 1046-SP8, and you have a large number of products affected by the VAT change:

See instructions here (PDF)

Winpos Store version instruction

- If you have Winpos Store program version:

See instructions here (PDF)

If you have problems with the changes, please contact Winpos Helpdesk:

helpdesk@winpos.fi, tel. 063462012