The new general VAT rate of 25.5% comes into force in Finland from 1 September 2024.

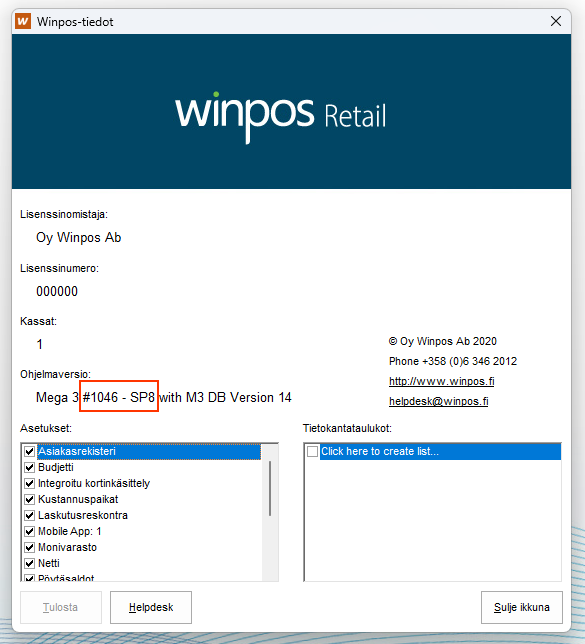

Before making any changes, first check in the Backoffice program, which program version you have.

You can find the software version information in the “About Winpos” window of Winpos Backoffice. Open Backoffice -> About Winpos

Note!

If you use Finvoice or Procountor, notify this to alv.info@winpos.fi no later than 31.7.2024. Your program version requires a separate update before you can make the VAT changes according to the instructions below.

Instructions for making VAT changes in your Winpos POS system:

Winpos Mega Store version instructions

- If your program version is 1046-SP8 (or later):

See instructions here (PDF) - If your program version is any other than 1046-SP8, and you have a small number of products affected by the VAT change:

See instructions here (PDF) - If your program version is any other than 1046-SP8, and you have a large number of products affected by the VAT change:

See instructions here (PDF)

Winpos Store version instruction

- If you have Winpos Store program version:

See instructions here (PDF)

If you have problems with the changes, please contact Winpos Helpdesk:

helpdesk@winpos.fi, tel. 063462012